Resources

A collection of free resources to help you raise funds and share the work we do

By Errikos Andreakos

Seafarers have faced unprecedented hardships over the past two years. While the pandemic and the many restrictions associated with it have now been lifted, the global geopolitical uncertainties, increased sanctions and demands for compliance, particularly in relation to the conflict in Ukraine, are further threatening seafarer welfare, particularly when it comes to payment of wages.

The current situation has highlighted two key points. Firstly, it is critical that companies act swiftly to protect the interests and wages of their seafarers. And secondly, the shipping industry’s current system for paying crew salaries and suppliers as well as the general management of cash on board vessels is outdated.

The shipping industry relies upon multiple urgent, cross-currency and cross-border microtransactions to ensure smooth and reliable trading. However, the current methods that vessels use for paying salaries to crews and invoices for ship chandlers, agents and other suppliers require a significant amount of cash to be stored on board. Not only does this present a real security risk and create administrative overheads, with transaction and foreign exchange costs coming in at between 3% to 5%, it’s also very expensive.

Most crew members are paid by cash distributed on board the vessel in addition to a wire transfer back home to their families. However, wire transfers are expensive and inefficient to manage which often causes delays in payment to crews. On top of this, if a company pays a seafarer in dollars, which requires conversion to another currency at the receiving bank, they are again impacted by significant exchange rate costs. Understandably, every dollar is important to the crew member and their families and many well-meaning ship owners want to do right by their seafarers.

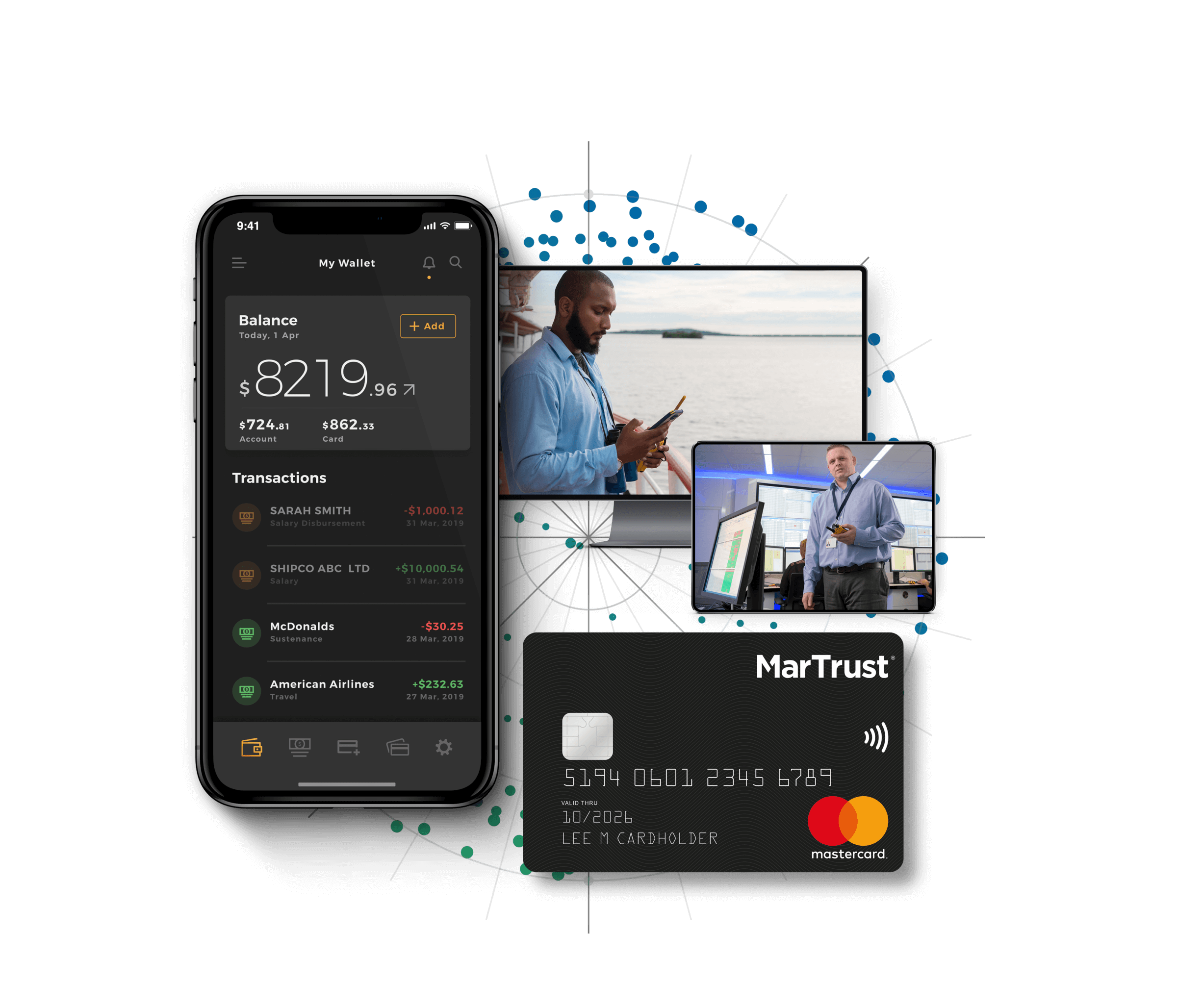

While the Covid-19 pandemic has caused unparalleled hardships, it has also forced and accelerated digitalisation and the development of digital solutions within the shipping industry; an example of this is a move away from cash-to- master (CTM) payments. At MarTrust, we launched a new solution even before the pandemic that combines a crew welfare solution with vessel expense requirements. The MarTrust E-Wallet and card is a payment solution that enables companies to transfer funds to multiple accounts and execute payday and CTM transactions with increased control, transparency and security. This includes paying crew salaries, suppliers, agents and any other stakeholder involved in the day-to-day operation of a vessel.

As an integrated payment solution, it is founded upon modern e-wallet and pre-paid card technology and designed to optimise the entire payroll process for ship owners, ship managers and manning agencies. It can be accessed via a web portal or mobile app anywhere and at any time and can be seamlessly integrated into existing systems. From there, funds can be easily and securely transferred direct to crew to pay salaries, bonuses, overtime and cash advances.

As a digital solution, it reduces the need for seafarers to manage or store significant amounts of cash, providing increased security and peace of mind. By using the debit card, cash can be accessed at any Mastercard-supported ATM around the world. It can also be topped up in up to eight different currencies, making it a local solution in these countries, which substantially reduces fees and provides complete flexibility.

As part of a future development, the MarTrust E-Wallet will include a new Salary on Demand service, which enables seafarers to track and use their income at any time anywhere.

Additionally, it will help shipping companies optimise their cash flow, eliminate the administrative costs and hassle associated with maintaining salary advances, and save money on banking transfer fees and other charges associated with CTM payments to advance salaries to seafarers.

Crew welfare is a critical challenge for the shipping industry and we must all take responsibility for ensuring and improving the wellbeing of seafarers while at sea. Protecting their wages and ensuring that their families are looked after and have access to funds is a critical part of this, and the advancements that we are seeing in digital solutions is the route to achieving this. While the well- trodden phrase ‘cash is king’ may still ring true, a ‘cash-free’ shipping industry is a safer, more sustainable, and more economic path to tread.

Errikos Andreakos is chief commercial officer of MarTrust, www.martrust.com.